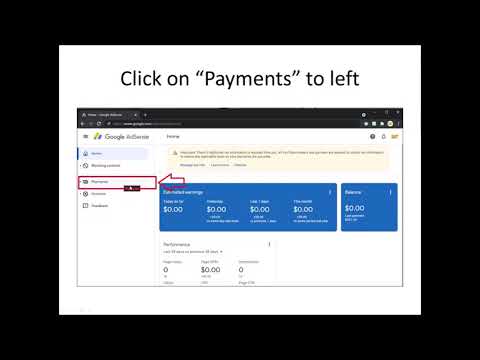

True, today I'll be talking about how to get to the managed tax info webpage for AdSense. This is for people who do blogging or use YouTube to generate revenue from AdSense ads. That's my kid in the background with a really bad cold. He's going to be breathing heavily and sniffling, but it's fine. I have to do two jobs at once right now. You might want to access the manage tax info page to enter your W9 if you're in the United States or to change access to your 1099 form. So, the prerequisite first step you want to do is log into your AdSense account. From here, follow these steps to get to the manage tax info webpage. It's not easy to find because it's not available on the left side of your AdSense homepage. Sometimes they include a notification about how to access it, but I'm really surprised that they don't make it easier. Anyways, you'll just have to click on 'Payments' on the left side and then scroll down to 'Manage Settings' at the bottom. Finally, go to 'Payments Profile' and look for your United States tax info. Click on the pencil icon, then click 'Manage Tax Info'. That's how you get there. Okay, I should actually show it, but I didn't do it as a live recording because it contains personal and private information. I wanted to erase unnecessary stuff. Once you're logged into the AdSense homepage, on the left side is the 'Payments' navigation link. Click on that. I'm surprised they don't have a separate 'Tax' link instead of 'Settings', but anyways, once you click on 'Payments', you'll be taken to the payments info page. Scroll to the bottom where it says 'Settings' and click on 'Manage Settings'. From here, it takes you...

Award-winning PDF software

W9 Form 2024 MS: What You Should Know

Note : Form W9 is filed with each personal and business tax return. The forms are located on IRS.gov's Free File web page. Form W-9 — Mass.gov Enter your TIN in the appropriate box. Note: Form W9 is filed with each personal and business tax return. The forms are located on IRS.gov's Free File web page. Form W9 — Mass.gov Enter your TIN in the appropriate box. Form W-9 — Mississippi Purpose of Form. (e) to (h) The form includes instructions to the taxpayer. In order to use this form, prepare your return as prescribed by you and report the information provided. (i) The return must be prepared in proper form and furnished on schedule “I.” If you do not file a Form 1040NR (corporate tax return), the person submitting the form must be able to demonstrate to your satisfaction that the company is exempt from filing a corporate tax return. As a condition of receipt of this form, a completed Form 5498 (Application for Certain Tax-Exempt Interests) (Form 8829 (PDF)) should be filed. All income earned by the exempt person under this section (generally, from investments with individuals and partnership or S corporation shareholders) may be exempt from federal income tax. (j) The return must be filed electronically. If you are using a third party software program to conduct your return, follow the instructions provided therein. The IRS recommends that you use one of these programs to determine whether you are required to file a corporate tax return. If you use any other program to electronically prepare your return, make sure that the program has the ability to accept a form W-9. In most cases, your computer, printer, or software program will accept a completed Form 1040NR (corporate tax return) as an accurate and complete document as long as the information in the corporate tax return is correct. However, if you are unable to use software or other technology to prepare your income, then you should enter your 1040NR as provided in this instruction. (k) You must electronically attach an original and properly completed Form W-9. The document must be sealed, dated, and contain all the information.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Form 2024 MS, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Form 2024 MS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Form 2024 MS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Form 2024 MS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.

Video instructions and help with filling out and completing W9 Form 2024.